Although there are disagreements on the amounts, county officials agree that millions in reserve funds have been spent in the past 3½ years.

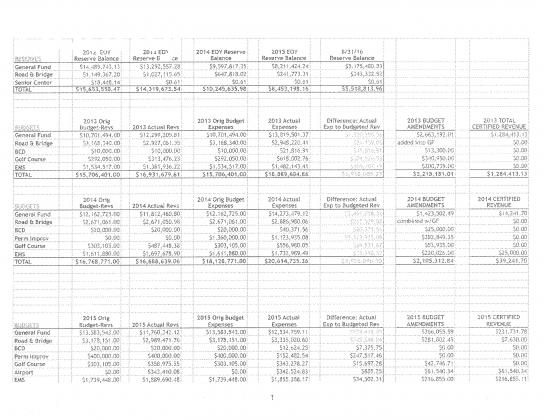

Scurry County’s reserve funds dropped by more than $7 million between Dec. 31, 2012 and Dec. 31, 2015, according to figures from the Scurry County Auditor’s Office. As of Aug. 31, 2016, the county has just more than $5.5 million in reserves, but that figure will change before the end of the year.

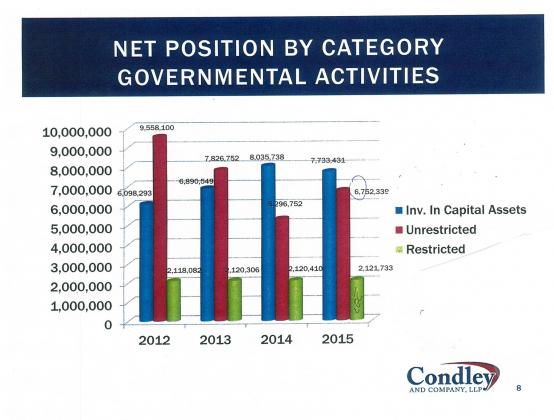

Scurry County Judge Ricky Fritz disputes those numbers, citing a handout from the county’s outside auditor Condley and Company, LLP.

“We are going to have to agree to disagree. I stand by the information provided by Condley and Company,” Fritz said, adding that the bar graph includes a line for unrestricted net position.

On Thursday, Fritz talked to a representative at Condley and Company about the handout. After speaking by phone to the outside auditor, Fritz said he would like time to think about what he was told on the call and during past audit presentations. On Friday, Fritz said he stood by the Condley handout that reserves were the unrestricted net position part of the chart.

Fritz said the unrestricted net position total in the certified audit, to him, represents “money we are able to spend.”

County Auditor Angela Sanchez said reserves are defined as “money the county is able to invest through the Public Funds Investment Act that can be used to cover expenses.”

After reviewing figures from the county auditor’s office, Pct. 1 Commissioner Terry Williams said those figures showed county reserve totals. During a meeting last month, Williams disputed a statement in a letter to the editor that claimed reserves decreased by $10 million.

“I am shocked. Seeing is believing,” Williams said after initially reviewing figures from the county auditor. “Where did I miss that. I knew that buildings needed to be done. Ninety percent of what we did needed to be done and 10 percent was overboard.”

Williams later said that he believed the year-end reserve totals include property tax money that was collected from October through December of each year that is budgeted money for the next year’s budget. He said that would make the money “restricted” because it can only be used for the next year.

The auditor’s office does classify that money as reserves until the end of the year in which it was collected, Sanchez said. It is moved Jan. 1 each year to the ad valorem tax line in the budget.

In 2012, the county collected $7.1 million in taxes during those three months, in advance of 2013. $7.3 million was collected in advance in 2013 for 2014, $7.7 million in 2014 for 2015 and $6.1 million in 2015 for 2016.

Fritz was told by the auditor’s office while preparing the 2017 budget not to count on using reserves to help offset expenses. Commissioners ultimately voted to add six cents per $100 valuation to the tax rate that Fritz originally proposed to cover the forecasted revenue shortage.

With a more than $16 million budget, the county currently has about four months of reserves available for daily operations.

“It all comes down to what is an adequate reserve,” Fritz said. “I think six months is adequate. I have been told that to get below six months is not good business practice.”

That was one reason why Fritz’ original budget did not include subsidies for the Scurry County Museum, which is not affiliated with the county, or the secretary at the Department of Public Safety office. Commissioners voted to reinstate those subsidies as well as overtime and other expenses that had been cut from the original proposed budget when they first reviewed the budget last month.

The commissioners’ court adopted a property tax rate of 38 cents per $100 valuation since an $84 million mineral valuation error was reported to the Scurry County Appraisal District.

Fritz’ original proposed budget had a 32 cent per $100 valuation tax rate.

On Dec. 31, 2012, the county had a reserve balance of more than $15.6 million and as of Aug. 31, 2016, the balance was just more than $5.5 million. The county also has funds in accounts to pay off the bonds for the law enforcement center construction and for operations of Hermleigh Water Works. Those funds cannot be used for any other purpose, and are not reflected in the figures used in this story.

The county, in 2012, was experiencing growth, Fritz said, and that led to work being done.

“Now, we are in a shrinking mode and watching what we spend,” he said. “At this point, we are more particular about our reserves.”

Fritz and other county officials until recently had been referring to the reserves as the county’s savings account.

After Fritz took office, the court agreed to use the reserve fund for all capital expenditures and improvements throughout the county. Fritz said improvements have been made in the county’s parks, the Scurry County Library, Scurry County Senior Citizens Center, Scurry County Boys and Girls Club, Scurry County EMS, Scurry County Courthouse and Scurry County Courthouse annex.

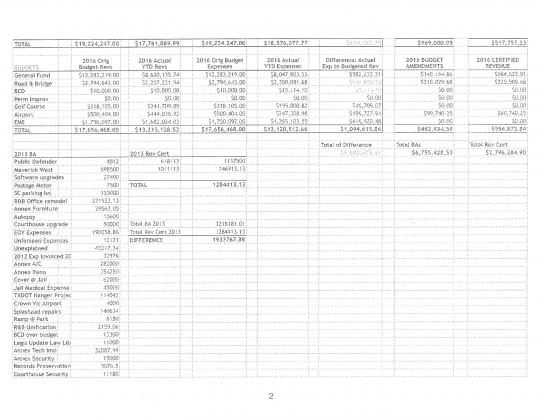

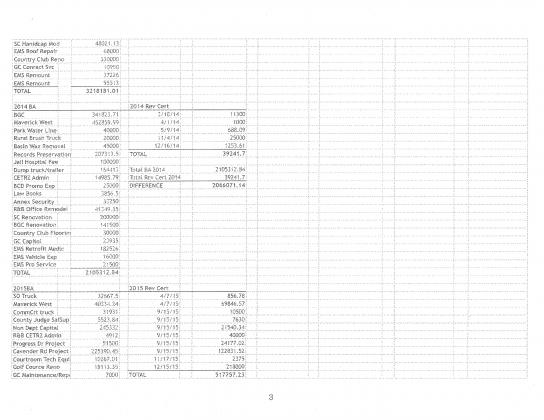

The county spent $487,250 on renovations at the courthouse in 2014 and $713,700 to renovate the former law enforcement center into the courthouse annex.

Fritz said the county did not increase the tax rate in order to make the improvements because it had enough in reserves to do the projects and make the purchases.

“We did all of the capital improvements without raising taxes,” he said, adding the county did not have to borrow money to make the improvements.

The county also had to dip into the reserves for $341,823 after it took over the Boys and Girls Club in 2014. The county had to add money to the budget because it took over the operations and it was not included in that year’s budget, Fritz said.

Also pulled from reserves were any shortfalls in sales tax revenues, which have fallen short of the budgeted amounts the past two years. Fritz said the county lost $1 million in sales tax revenue over the two years and said tax collections from property owners has also been down over the past few years.

In 2013, 2014 and 2015, the county also had to move money from reserves for spending more than was budgeted. In 2013, more than $1.9 million was pulled out to cover the deficit while near $4 million was pulled out in 2014. The 2015 total was $814,187.

Unforeseen expenses also come out of reserves, including $437,631 in golf course renovations in 2013 and $175,047 in roof repairs at the golf course in 2014, $282,000 for a heating/cooling unit at the courthouse annex, $200,000 for repairs at the Scurry County Senior Citizens Center, $199,531 in records preservation in the district clerk’s office in 2012 and $101,134 for splash pad repairs in 2013.

The county also had to pull $105,000 out of reserves in 2014 for a Scurry County Jail inmate’s surgery.

Fritz said the apartment complex that the county agreed to lend nearly $3 million is considered a “dead issue” because the company never returned for final approval of the county funds.

The loan was to be made to Texas Housing Foundation of Marble Falls, which applies for tax credits through a state program, for a complex that would have been built near Progress Parkway, which was cleared but never completed.

The county does receive additional revenues throughout the year in the form of certified revenues.

In 2013, $1,137,500 was added to the budget from land sales at Maverick West, Fritz said. In March 2013, 22 lots at Maverick West were sold for $13,000 each, or $286,000. At the time, the county’s engineers estimated a development cost of more than $10,500 for each of the 91 lots.

Williams said another example is that the Winston Field airport purchases fuel in advance in the form of a budget amendment, but that is paid back to the county after the fuel is purchased by customers.

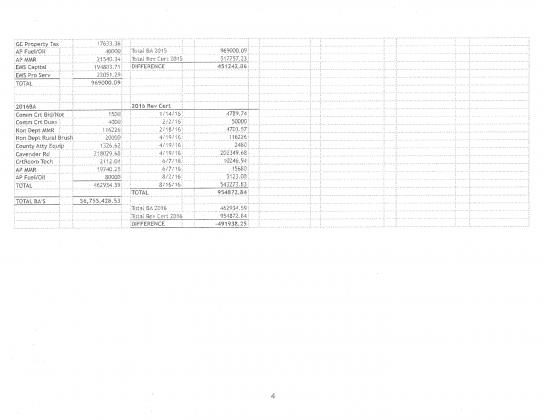

The county auditor’s figures show that there have been budget amendments of almost $6.8 million since Dec. 31, 2012, certified revenues of nearly $2.8 million and $5.6 million in deficit spending.